UK new car registrations rise only modestly in September

4 October 2019

New car registrations in the UK grew by a modest 1.3% year-on-year in September, according to the latest data released today by the Society of Motor Manufacturers and Traders (SMMT).

This result underlines the weakness of the UK new car market as demand suffered a substantial 20.5% decline in September 2018 as the new WLTP emissions regulations and lack of testing capacity across Europe affected supply.

The growth in September 2019, of 4,421 units, was not enough to recover the loss of over 87,000 registrations in last year’s important plate-change month. The modest growth in the UK is in stark contrast to the performance of other major European car markets, which enjoyed double-digit growth in September following significant downturns in demand in September 2018.

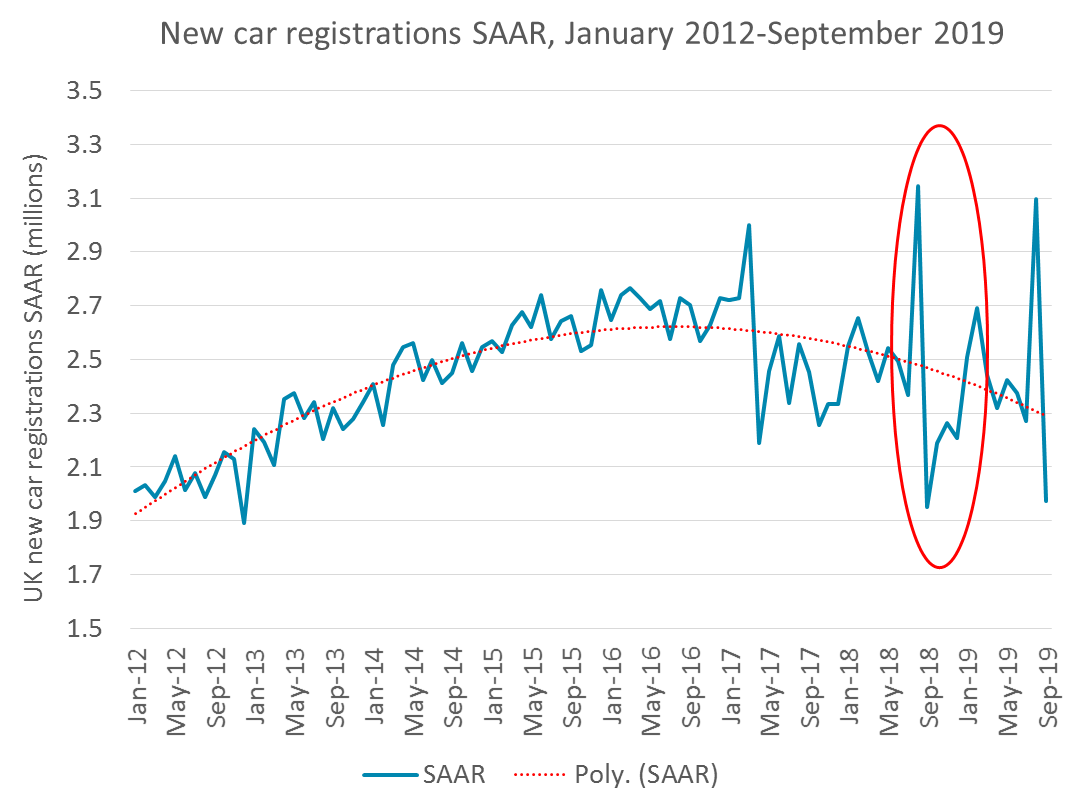

Autovista Group analysis of the latest UK registration figures also reveals that the seasonally-adjusted annualised rate (SAAR) fell to its lowest level in September 2019 since the WLTP disruption to the market in September 2018.

Source: Autovista Group based on SMMT data

The SMMT emphasises in its statement that ‘while the same regulatory upheaval has been experienced across the EU, in the UK the market is being subdued by the added pressure of political and economic uncertainty, with weak confidence stopping consumers from committing to big ticket purchases,’

Mike Hawes, SMMT Chief Executive, said ‘September’s modest growth belies the ongoing downward trend we’ve seen over the past 30 months. We expected to see a more significant increase in September, similar to those seen in France, Germany, Italy and Spain, given the negative effect WLTP had on all European markets last year. Instead, consumer confidence is being undermined by political and economic uncertainty.’

‘We need to restore stability to the market, which means avoiding a ‘no deal’ Brexit and, moreover, agreeing a future relationship with the EU that avoids tariffs and barriers that could increase prices and reduce buyer choice,’ Hawes added.

PHEVs fall, BEVs rise

September’s volumes were driven by the fleet sector, which grew 8.6%. Meanwhile, private demand remained stable, up 0.1%, while business registrations declined by 44.8%. Diesel registrations fell 20.3% whereas petrol cars experienced a moderate increase of 4.5%.

There was, however, good news for battery electric cars (BEVs), which saw the biggest percentage growth of all fuel types, up 236.4% (5,414 units) as new models boosted registrations. Plug-in hybrids (PHEVs) also saw growth for the first time in six months, albeit following a 22.3% decline in the same month last year. In the year-to-date, PHEV registrations are 29.2% lower than in the first three quarters of 2018. By comparison, non-rechargeable hybrids and BEVs are up 32.4% and 125.1% year-on-year respectively compared to the same period last year.

Brexit uncertainty clouds the outlook

The UK new car market declined 2.5% year-on-year in the first three quarters of 2019 and is 49,000 units lower than in the same period in 2018.

Looking ahead, the uncertainty surrounding Brexit, which is due to happen on 31 October, continues to cloud the outlook. Despite declines in new car registrations in the final three months of 2018 compared to 2017, due to ongoing disruption to supply as a result of the implementation of WLTP, demand is expected to be weaker in each month in 2019.

Autovista Group forecasts that 2019 will finish 2.9% down on 2018 in its baseline forecast. If the UK leaves the EU without a deal, the impact is expected to be more severe and the downside forecast calls for a 3.4% drop in 2019. If Brexit is delayed, or even cancelled entirely, the downturn is expected to be more modest, with a fall of 2.5% expected in this upside scenario.

The outlook for 2020 will also depend on the Brexit outcome and the forecast has a broad range as a result. The baseline forecast is for growth of 1.5% in 2020 but the upside scenario forecasts growth of 4.0%. The downside forecast is for a market contraction of 4.0% in 2020.